Mobile money disclaimers

EMAIL DISCLAIMER

This e-mail message and all information contained therein is confidential information meant solely for the intended addressee and purpose. If you are not the addressee, you are unauthorised to access this email and you may not disclose, copy, distribute or take any action based on the contents hereof. If you are not the intended addressee, kindly inform the sender immediately and destroy all copies hereof. Any copying, publication or disclosure of this message, or part hereof, in any form whatsoever, without the sender’s express written consent, is prohibited.

The views or opinions expressed or implied by the sender do not necessarily constitute the opinion of TYME. This message does not constitute a guarantee or proof of the facts mentioned herein. No employee or intermediary is authorised to conclude a binding agreement on behalf of TYME by e-mail without the express written confirmation by a duly authorised representative of TYME.

WEBSITE DISCLAIMER

The information contained in this website is for general information purposes only. The information is provided by TYME and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Every effort is made to keep the website up and running smoothly. However, TYME takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Mobile money Terms & Conditions

1. General introduction

“Mobile Money” is brought to you by MTN (Pty) Ltd and is available in Pick ‘n Pay and Boxer outlets.

Mobile Money gives you, the customer, the ability to withdraw and deposit cash, send money to any person who meets the qualifying criteria, buy products and services such as pre-paid electricity and pre-paid airtime, pay for goods and services at selected pay points, receive money by way of electronic funds transfer and link debit orders. The Mobile Money account does not afford you any credit overdraft facilities.

All South African Residents, with a valid South African Identity Number, who are 16 years or older and have an operational cell-phone number are eligible to open a Mobile Money account, on a basis of one account only per customer (“qualifying criteria”). This is also subject to successful fraud and risk control checks.

To use Mobile Money, you first need to open your Mobile Money Account. This Mobile Money account is operated by TYME, an authorised distribution channel of the South African Bank of Athens Limited. The bank account which you open shall be held by the South African Bank of Athens Limited (“We/ Us”).

Please read the terms and conditions set out below, carefully. If you do not understand any part of them or how they apply to you or you would like to get more information, please contact us with your questions or concerns. You may contact our Customer Care Centre at 083 123 0145 prior to opening an account or while using any of the services provided.

2. Mobile Money Terms and Conditions

When you open a Mobile Money account, you enter into an agreement with Us and the following terms and conditions shall apply. By opening the account, you agree that you have read, have understood and agree to be bound by the terms and conditions.

We shall advise you of any change in these terms and condition in the same way as outlined in section 2.1 below.

2.1 Account limits and fees

Certain limits apply to the value of the transactions you may make and to the balance you may hold in your account. The daily and monthly debit spend limits include the total value of any goods and services purchased, cash withdrawals made, monies sent and debit orders paid. The maximum applicable limits are currently as follows:

- Daily debit spend of R1 000;

- Monthly debit spend of R25 000;

- Account credit balance of R25 000 at any point in time

Refer to www.pnp.co.za/mobilemoney OR www.boxer.co.za/mobilemoney for limit changes.

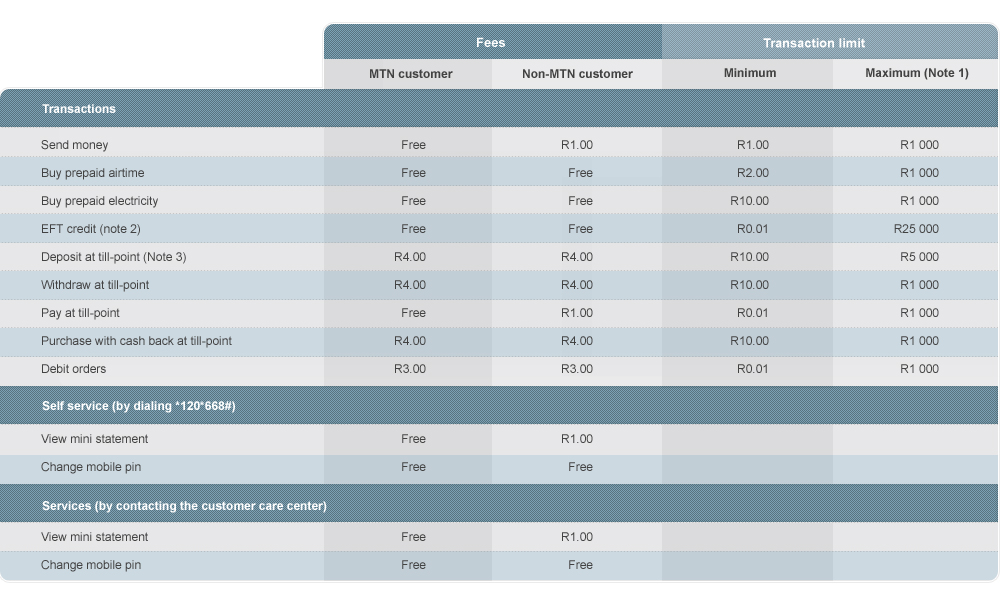

The following fees and limits apply:

Notes

- We can reject your transaction request if it means that the daily debit or monthly debit spend will be exceeded.

- Your EFT credits are limited by the maximum account credit balance of R25 000 at any point in time. We can reject your EFT Credit request if it means that the maximum account credit balance will be exceeded.

- Deposits at till-point: Only cash will be accepted. No bank cards or cheques accepted.

We shall advise you of any changes to fees and limits at least 20 days before these changes take effect through a combination of the following channels: the Customer Care Centre, the internet or mobi site, Mobile Money Activation Agents or via SMS. When fee changes are made, you may close your account and terminate this agreement.

2.2 Interest

No interest will be earned by you on the amounts held in your Mobile Money account.

2.3 Accessing your Account

Unless We advise you differently, you can only access your account and perform transactions by using your cell phone.

2.4 Account closure and termination of this agreement

We have the right to close your account based on legal, compliance and other relevant considerations and where possible, upon reasonable notice to you. You also have the right to close your account. If you close your account, you must advise Us. The closure of your account shall result in the termination of this agreement. Closing your account shall be subject to your account being in good standing.

2.5 Assignment of this agreement

We have the right to assign this agreement to another bank and you hereby agree to such assignment. We shall notify you of such an assignment. We undertake to ensure that your funds are not affected by such assignment.

2.6 Dormant accounts

We have the right to close your account in the event that you do not comply with the rules which apply to the use of your account or you do not transact on your account for such a period as We, at our discretion, may determine from time to time. We will attempt to inform you in the event that we intend closing your account and you shall be entitled to withdraw your funds before We close your account. If you do not withdraw your funds before the account is closed, We shall transfer those funds into a special account where they will be held until such time as you request the withdrawal.

2.7 Change to personal information

You must keep us informed of any changes to your personal information. This includes changes to your name, address, cell phone number or email address.

2.8 Risk in unauthorised transactions

Unless you formally instruct Us to stop any unauthorised transactions on your account, you will bear the risk and loss resulting from the unauthorised transactions made. You must call the Customer Care Centre on 083 123 0145 to issue this instruction.

3. Customer consents to personal data and information

3.1 Personal data and information

When you open an account, you will need to supply us with the following information (“Opening Account Information”):

- Full Name; and

- Identification number

You hereby consent to Us collecting, using and storing this information for the purposes of effecting the necessary processes required to validate the Opening Account Information and to open the Mobile Money account should all the qualifying criteria be met.

3.2 Mobile Money transaction account information

Once the Mobile Money account has been opened, you hereby consent to Us accessing, recording, storing and using the following information “(Transactional Information”)

- Account balances from time to time;

- Transactional history, including but not limited to history of purchases, transactional amounts, date, time place and nature of transactions.

- Contact details such as, but not limited to, your cell phone number and email address.

For the duration of this Agreement, you consent to using this information for the purposes of:

- Transaction verification and authentication;

- Fraud detection and risk management;

- Improving our internal operations and efficiencies;

- Targeted marketing of our goods and services to you;

- Targeted marketing of goods and services on behalf of third-party companies, when we believe that these offers may be of interest to you. We may also give this information to third parties for them to contact you directly about such goods and services;

- Provision of analytical ratings about your transactional patterns and behaviours to third-party companies; and

- Customer care data and information, including call centre reports and sales assistance information.

3 3 Protection of Information

We will ensure that the Opening Account Data and Transactional Account Data will not be used in an unauthorised manner.

3.4 Direct Marketing and Special Promotions

By entering into this agreement, you hereby consent to receiving special promotional offers on third-party goods and services. This may be marketed to you through Us and/or third parties that We select, via SMS, USSD, SmartApp, and/or other electronic means.

4. Things you need to know

- You can contact us for customer services via the following channels: Mobile Money Activation Agents, mobile services, online account management or over the phone through the Customer Care Centre at 0831230145.

- You can request a statement of your Mobile Money account by calling the Customer Care Centre on 083 123 0145. Fees will apply for the issuing of statements. Refer to www.pnp.co.za/mobilemoney OR www.boxer.co.za/mobilemoney for details on fees payable.

- Your Mobile Money PIN is strictly confidential. Do not disclose your PIN to anyone, and specifically not to Mobile Money Activation Agents or any of our employees. In the event that your PIN is compromised, please contact the Customer Care Centre immediately.

- In cases of theft or fraud, we may require you to open a case with the South African Police Services.